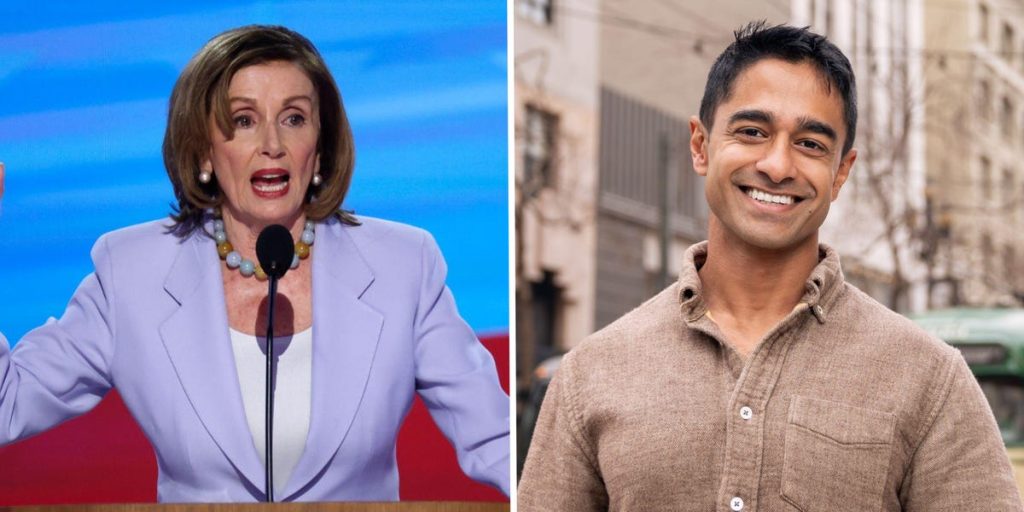

The political landscape in California is shifting, and the upcoming race to replace Nancy Pelosi in Congress is already generating significant buzz. Not just because of the seat’s historical importance, but also due to the financial profiles of those vying for it. With Pelosi announcing her retirement, attention has turned to her potential successors, and one candidate, Saikat Chakrabarti, stands out – not only for his progressive platform but also for his substantial wealth, potentially making him one of the richest members of Congress. This article delves into the financial details of Chakrabarti and Pelosi, examining the implications of wealth in politics and the dynamics of this crucial election.

The Wealth of Nancy Pelosi and Her Potential Successors

For decades, Nancy Pelosi has been a prominent figure in American politics, and with that prominence has come considerable wealth. Alongside her husband, Paul, Pelosi’s assets are valued between $100 million and $422 million. This figure has often been a point of discussion, particularly given her role in shaping economic policy. However, the potential for a successor even wealthier than Pelosi is now a reality.

Chakrabarti, a progressive activist, has declared his candidacy and revealed a net worth of at least $167 million, a figure that could be significantly higher. This raises questions about the role of personal finance in representing the interests of constituents.

A Deep Dive into Pelosi’s Finances

Pelosi’s financial disclosures reveal a portfolio heavily invested in real estate and technology stocks. In 2024, her husband held between $25 million and $50 million in Apple stock alone. Significant holdings were also reported in Alphabet (Google), Salesforce, NVIDIA, Microsoft, and Amazon, each valued between $5 million and $25 million.

Additionally, the Pelosis have liabilities, primarily mortgages, ranging from $36.5 million to $106 million. These disclosures, while providing a range of values, offer a glimpse into the financial interests of a long-serving member of Congress.

Chakrabarti’s Fortune: From Stripe to the Campaign Trail

Unlike Pelosi, whose wealth accumulated over years of political influence and strategic investments, Chakrabarti’s fortune stems from his early career in the tech industry. He was a founding engineer at Stripe, the online payment processing company, and his equity in the company is the primary driver of his substantial net worth.

Chakrabarti himself acknowledged the surprising nature of his wealth, stating in an email to Business Insider, “After I helped build the payment processing company Stripe, I became a centimillionaire — at least on paper… It was a shocking and weird experience, and of course, I feel incredibly lucky.” He further emphasized that this experience has given him insight into wealth inequality in America.

His financial disclosure indicates holdings exceeding $50 million in both Stripe equity and a Fidelity investment fund focused on US government securities. Beyond these major assets, Chakrabarti’s wealth is spread across numerous other investment funds. He has already reported investment income of at least $16 million since the beginning of 2024, compared to the Pelosis’ $8.9 million in investment and rental income during 2024.

The Implications of Wealth in Politics

The significant wealth of both Pelosi and Chakrabarti highlights a broader trend in American politics: the increasing financial resources of elected officials. This raises concerns about potential conflicts of interest and whether these individuals are truly representative of the average voter. The debate around campaign finance reform is particularly relevant in this context.

Chakrabarti is attempting to position himself as a different kind of candidate, one who understands the system from the inside but is committed to challenging it. He has largely self-funded his campaign, with 75% of his campaign funds coming from personal loans. He argues that the American economy shouldn’t be a “winner-take-all battle for survival” and advocates for policies like Medicare-for-all, affordable housing, and a wealth tax on the ultra-rich. This stance, while progressive, is somewhat unusual given his own financial standing.

A Crowded Democratic Primary

The race to succeed Pelosi is shaping up to be competitive. State Senator Scott Wiener announced his candidacy before Pelosi’s retirement, focusing on housing policy and AI safety. Connie Chan, a San Francisco Board of Supervisors member, has also entered the race, subtly differentiating herself from Chakrabarti by stating she “didn’t make money in tech.”

Interestingly, Pelosi’s daughter, Christine Pelosi, initially considered a potential successor, has opted to run for the state Senate seat currently held by Wiener. This decision further opens up the field and adds another layer of complexity to the election. The focus on California politics will undoubtedly intensify as the primary draws closer.

The presence of multiple candidates with diverse backgrounds and policy platforms ensures a lively debate about the future of this important congressional district. The discussion surrounding wealth, representation, and the need for systemic change will likely be central to the campaign. Understanding the financial backgrounds of these candidates – coupled with their stated policy positions – will be crucial for voters as they make their decision. This story highlights the growing importance of political finance in shaping the narrative of modern elections.

In conclusion, the upcoming election to replace Nancy Pelosi is not just a contest of political ideologies but also a conversation about wealth and its influence in American politics. Chakrabarti’s candidacy, alongside those of Wiener and Chan, presents voters with a clear choice about the kind of representation they desire. As the campaign unfolds, the scrutiny of each candidate’s financial disclosures and policy proposals will only increase, ultimately shaping the future of this pivotal congressional seat.